How can I maximize my IRS tax deductions?

All Videos

How can I maximize my IRS tax deductions?

What are common mistakes individuals make when filing their taxes?

What are common mistakes small businesses make when filing their taxes?

For a business, it’s all about making sure you’re recording all of your business expenses and any home office and see if there’s anything else that you’re using for your business that you previously bought. So maybe contributing a laptop to the business, tracking your standard miles.

As an individual employee, and it’s not your company through a little bit more constrained and looking for doing IRA 401K planning or if you have other itemized deductions like a home mortgage or taxes, these sort of things you’re just going to want to make sure that gets into the proper software or you’re working with your professional but really it’s all about IRA and 401K type of retirement plans taking deductions now and getting the income later or other beneficial account such as a Roth IRA.

There can be some other things but really those are the main things tracking and expensing when you can as a business planning ahead and not having a year where you have huge income and then small income, you want to kind of smooth those tax years out. So you can take advantage of your lower tax brackets

Plan ahead.

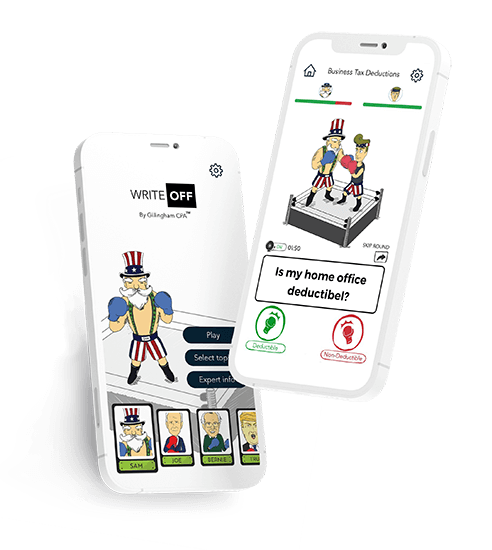

Write Off App

App for entrepreneurs to learn tax savings, structure correctly, & grow their business with an easy game.

A player chooses a character and plays each round against an opponent answering questions and learning on how to structure a business, pay less tax, and more along the way. It is a fun and interactive way to learn all you need fast!

About Us

Gillingham CPA is a San Francisco-based tax and accounting firm with a passion for helping clients grow their small businesses and navigating the tax waters. We specialize in consulting, boot-strapped startups, pre-series A ventures, and stock option -compensated employees. We take pride in providing services that go beyond just a tax return.

In addition to the general site, be sure to check out:

View All Videos