IRS Transcript Online

About

An IRS transcript is a document that provides a summary of a taxpayer’s tax account activity. This document includes important tax-related information such as the amount of taxes owed, payments made, and the dates those payments were received. Additionally, an IRS transcript online may also show any penalties or interest charged to a taxpayer’s account, as well as any adjustments made to their tax return. Taxpayers can access their transcripts online through the IRS website or by requesting a physical copy via mail. These transcripts are useful tools for taxpayers who need to provide proof of income or tax history to lenders, government agencies, or other interested parties.

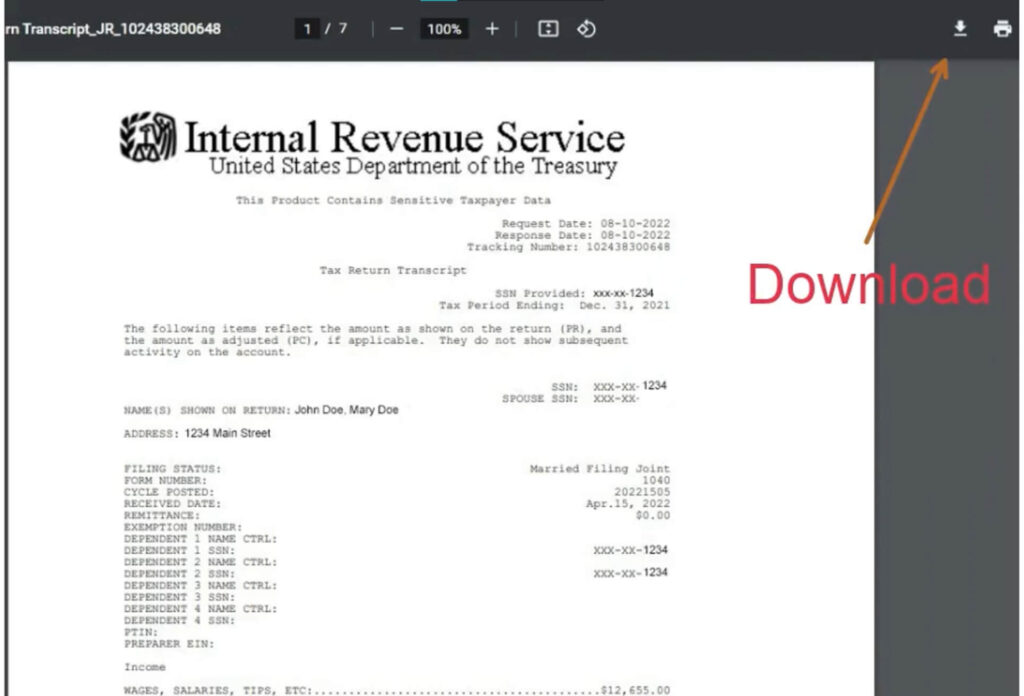

Here is what’s visible on transcripts:

- Last four digits of any SSN: XXX-XX-1234

- Last four digits of any EIN: XX-XXX4321

- Last four digits of any account or telephone number

- First four characters of the first and last name for any individual (first three characters if the name has only four letters)

- First four characters of any name on the business name line (first three characters if the name has only four letters)

- First six characters of the street address, including spaces

- All money amounts, including wage and income, balance due, interest and penalties

The IRS will provide unmasked Wage and Income transcripts when needed for preparing and filing tax returns. Unmasked Wage and Income transcripts fully display personally identifiable information such as the taxpayer’s name, address, and Social Security number along with the employer’s name, address, and Employer Identification number.

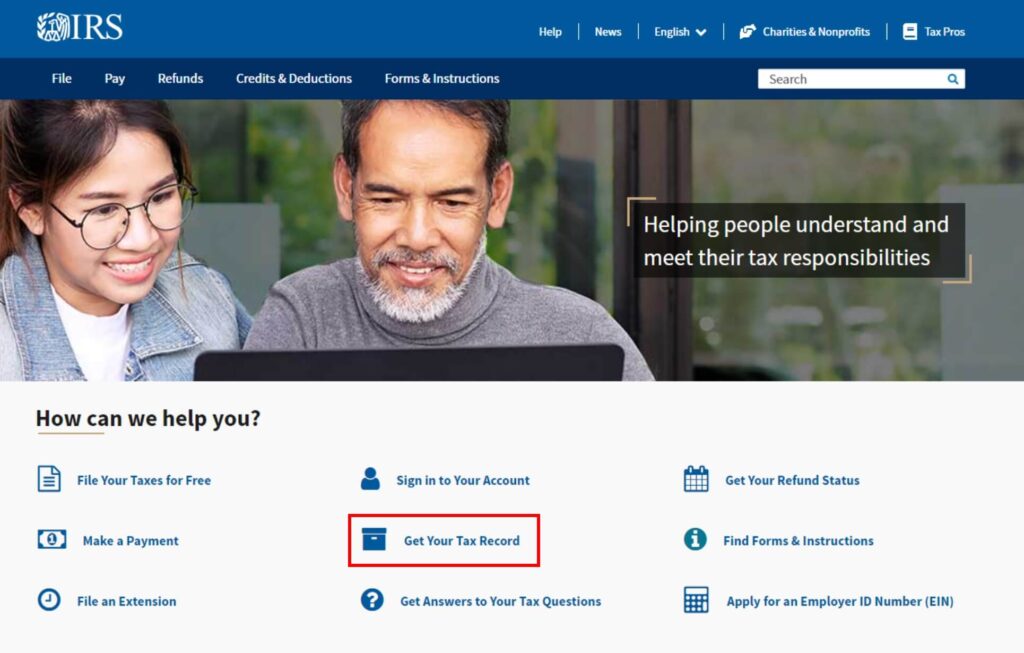

1. Go to the IRS website

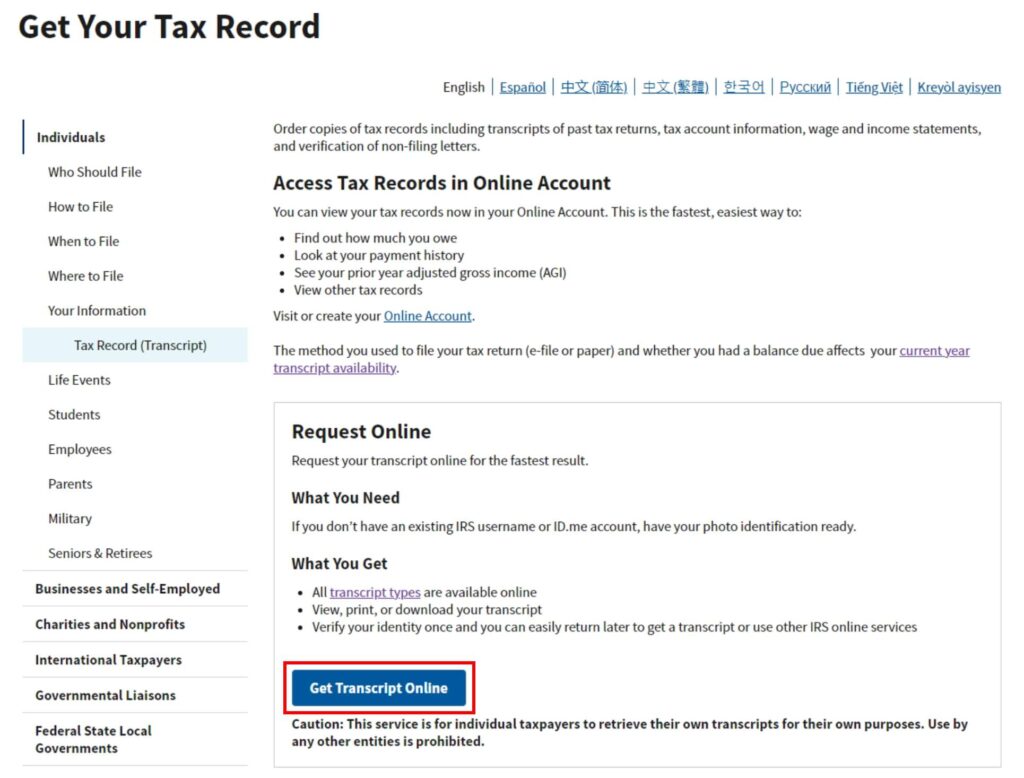

Go to the IRS website https://www.irs.gov/ and click on “Get Your Tax Record” under How can we help you? section, or you can just visit this link https://www.irs.gov/individuals/get-transcript/ and then click “Get Transcript Online” button

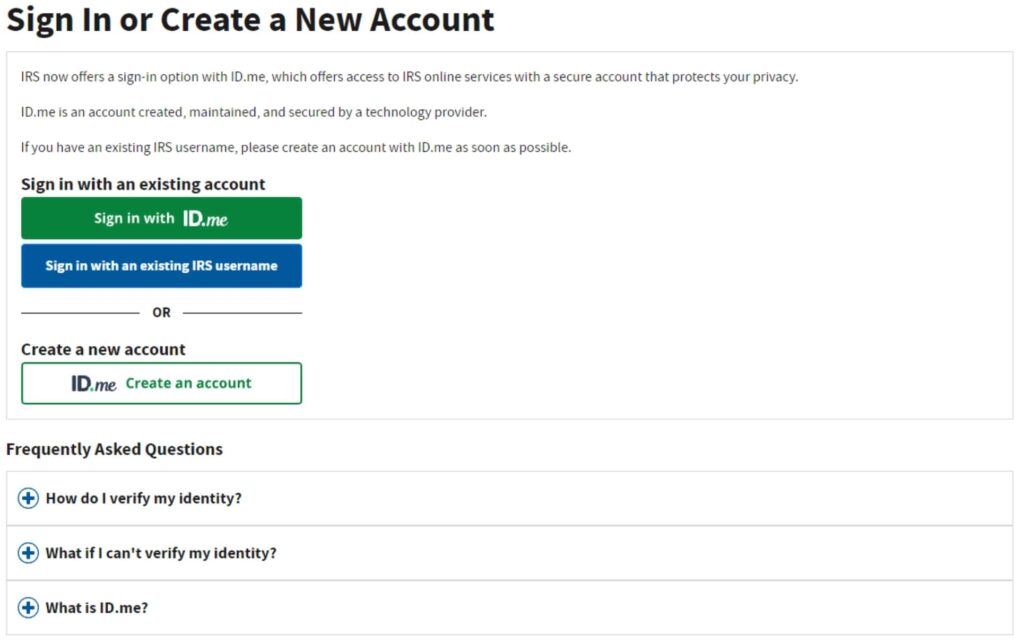

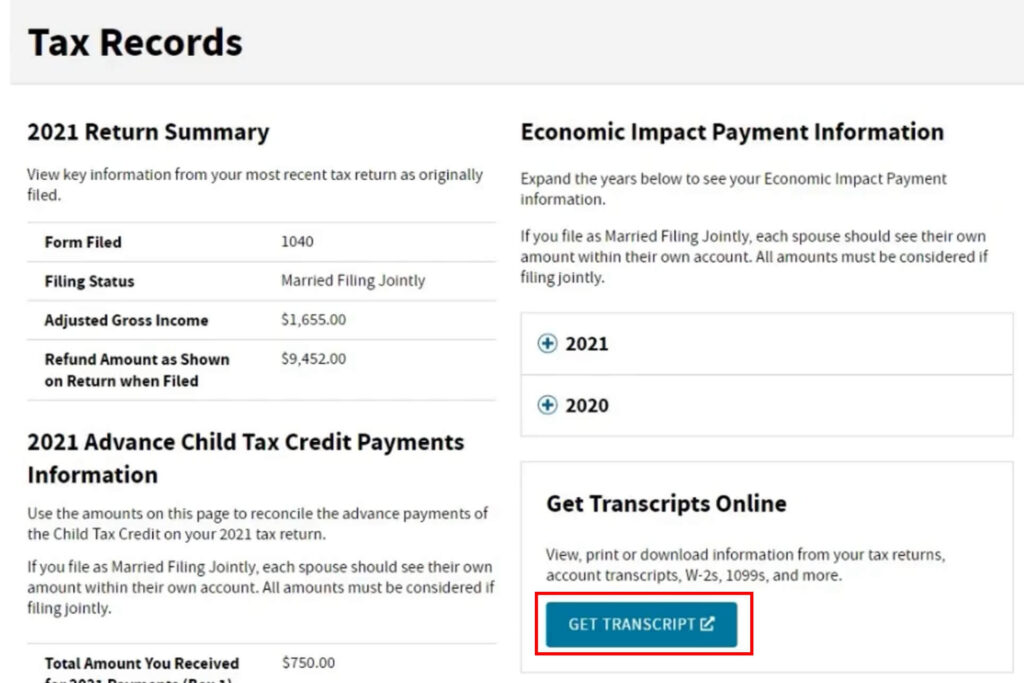

2. Sign In or Create a New Account

Please sign in if you already have an account, or you can create a new account, after you sign in go to tax record menu, and click “GET TRANSCRIPT” button

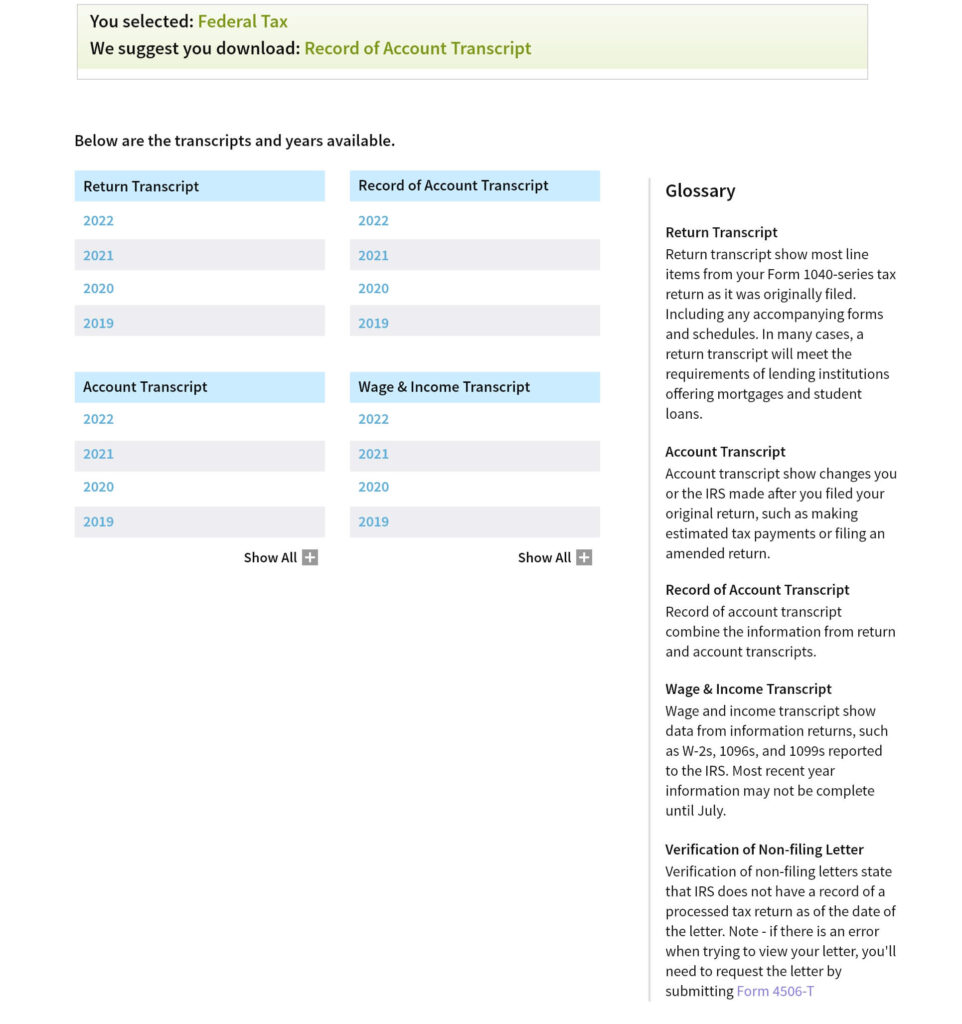

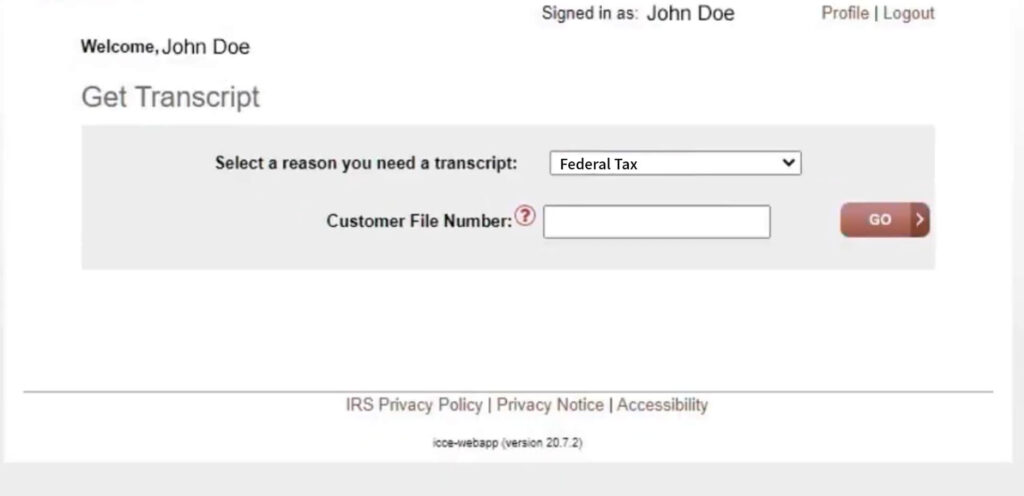

3. Get Transcript

Select Federal Tax for the reason you need a transcript field, and for the Customer File Number you can just leave it blank, and then click “Go” button

4. View or Download the Record as a PDF

The years are hyperlinked. When you click on the link, it will open your record as a PDF which you can download and save. We recommend downloading all document records. To see records for prior years, click the “Show All” button.