Our Commitment

We take the phrase “client engagement” seriously. Rather than rush to sign every new client we interact with, we prefer to really consider if and how we can offer value first. Only once we both conclude that the relationship will be mutually beneficial do we move forward

What We Consider

Fit

- Entrepreneur, business owner, equity compensation employee

- Need-based, not fixed fee

Delivery dates

- Extension very likely

- High quality, thorough, internal notes

Communication & work-flow

- Paperless

- Virtual communication is more cost-effective, but can do in-person if necessary

Value added

- Educational approach: we explain

- Collaborative: we work together

- Forward thinking: we plan

- Advisory: we take action

- Communicate: we answer

- Quality: we do not rush

- Tools: we empower

- Experience: we have been here before

- Perspective: we illuminate

Fit & Value Proposition

In an increasingly automated world, it’s important for us to constantly assess and adjust the value we provide. In addition to answering your questions and treating your unique tax profile with care, we’ll also be there for you when it’s time to make the tough decisions: “Should I exercise my options this year or next year?” “Should I defer the cost of new equipment or incur it now?” These issues aren’t black and white and the answers may be different from client to client.

With Gillingham CPA, you’ll have an experienced advisor to help you understand the long-term impact of your short-term choices and help you plan for a prolific and profitable future

Where can we add value?

- Compliance (task is arduous)

- Equity comp, small business, multi-entity, multi-state

- More than one stakeholder

- High dollar value where mistakes are costly

- Penalty avoidance

- Complexities like marital status, multiple properties owned, trust beneficiary, flow-through entity owner, etc

- Decoding the world of tax forms, attributes, & Rules (think AMT, ISO, NQS, P&L, BS and much more)

Tax advisory

Tax efficiency of deductions, savings, options exercises, and more

Cash flow planning

Calculating amounts due and when to pay

Savings and household finance

Tax efficient investment vehicles, cash flow analysis, asset and debt calculations, strategic accounts, and more

Accounting

Accurate and relevant books using a collaborative approach

Education

Answering questions, proactively explaining, leveraging technology

Perspective

We see a lot and want to collaborate

Intake Process

Here is how we evaluate prospective clients

Step 1 – Is there a need?

There should be a compelling need involving the following variables:

- Complexity requiring expert understanding of accounting and tax law

- Client time more valuable than our fee

- High dollar values with variability

Step 2 – Would you be better served elsewhere?

Is there an alternate solution that will provide better value for you?

- We've found these situations are generally best-served elsewhere: easy returns, one-off solutions, budget or rapid prep

- Is tax prep software or a lower-fee professional a viable alternative?

- We're looking for a "Goldilocks" fit so that our time and knowledged is best leveraged

- We are not "fast" and typically require a lot of client engagements to get to the finish line

Step 3 – Is it a “Goldilocks” fit?

- Equity comp not exceeding $2M per year

- Small businesses or solo entrepreneurs, bootstrapped/early-stage startups (pre-Series A)

- General annual fee target in the $2K-$5K range, though outliers exist

- Individuals with multiple complex income streams (side hustle businesses, rentals, multi-state filing, significant investment activity, flow-through owners or beneficiaries)

- Not generally fee or time-sensitive

Step 4 – Final Decision

By this point in the process we can see if it is a fit and layout a general plan

Areas of expertise, supporting services, and services not performed

Small businesses (including solo consultants), equity compensation, seed stage startups, and high income households often with rental properties are areas we provide the most long term value for the fees. Tax efficient investing across various vehicles such as IRA, 401K, rentals, and other deferrals are welcomed projects. Business structuring for tax efficiency is another specialty that we often do as a part of any annual tax business engagement as warranted.

Household cash flow analysis, forecasting, estate planning, merger and acquisition, corrective foreign work, speciality tax credits, complex sales tax / VAT compliance, and anything we believe will be best served in conjunction with other service providers. In other cases there are legal, investment, insurance, lending, and structuring needs that we are happy to direct you to better resources.

Please note some areas we do not work in are one time paid consultations or one time fixes for non-client issues with no ongoing needs. We also do not perform work with clients that have carried interest, law partners receiving K-1s, finance active participation K-1s, or fiscal year ends. No estate or nonprofit (501C3) work is performed, but can be referred out if needed. Foreign tax disclosure is something we can generally assist with, however, we are not cross-border tax advisors. Most often we can serve clients that are full year USA tax residents and then transition the client work to a specialist in this area once there is significant cross-border complexity. We do not perform nonresident tax filings or foreign tax return preparation.

Contact Us

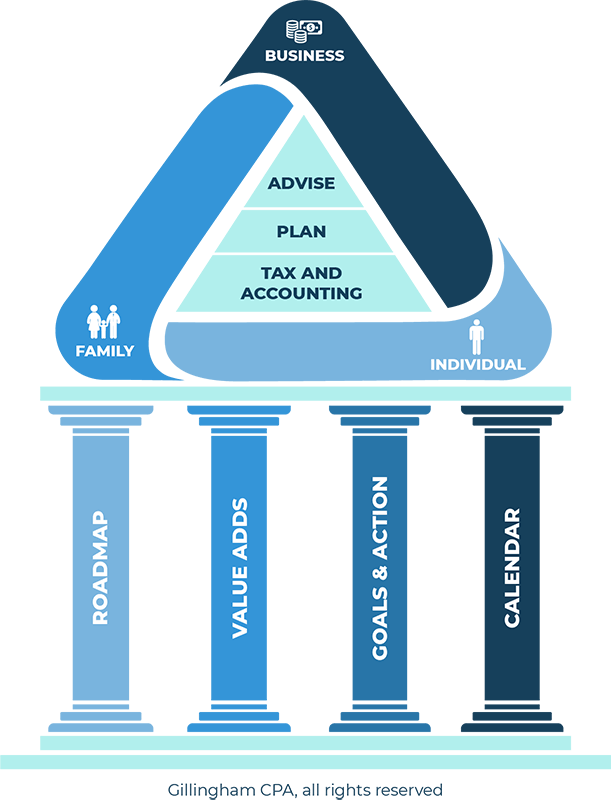

We look forward to working with you. Please click the contact form option below for more details. Check our cost page to find out about our firm pricing, and check out our Framework page to see the pillars that support the seven client types we specialize in