The purpose of the “Backdoor IRA” is so that a high income taxpayer (ordinarily high income taxpayers are excluded from a direct Roth IRA contribution) can still have a Roth IRA that is based upon converting a Traditional non-deductible IRA into a Roth IRA. If you have Traditional IRAs less than $10K this may be something worth looking at generally.

The general 1,2,3 which I can explain works like this for the Backdoor Roth IRA.

- See about interest in funding a Roth IRA even if over the regular income limits which may prevent a direct Roth IRA contribution.

(Roth IRA benefits are outlined pretty well across the web, but we are happy to explain) - Establish if we can do the Backdoor Roth IRA.

(Generally fine to do if all retirement funds are in Roth IRAs and 401K)

Clients with existing Traditional IRAs over $10K typically are not a good fit for the Backdoor Roth IRA because the IRS treats all the accounts as a single account when computing the taxes owed in the conversions.

3. We can then explain the process. (Traditional non-deductible IRA -> convert -> Roth IRA)

If qualified and want to move forward…

The details…

Note that when opening the “non-deductible Traditional IRA” it is possible that your investment custodian (Vanguard, Fidelity, Schwab, broker, etc.) will simply call it a “Traditional IRA” and the form that designates it as non-deductible will be filed with the IRS along with your annual tax return.

Here are the general steps and important points along the way:

Qualifying and Important Points

- Ensure that there are no existing pre-tax IRAs (tax deduction was taken for contributions at some point).

- It is possible that you have established a pre-tax IRA by contributing directly to such an account or rolled over a Traditional pre-tax 401K into a “Rollover” pre-tax IRA.

- It is ok to have other 401Ks.

*The issue with having pre-tax Traditional IRAs at the time of creating a “Backdoor Roth” is that this could create taxable income at the time of conversion So if you have existing pre-tax IRAs, generally the “Backdoor Roth” is not worth it – unless the existing deductible Traditional IRA is a trivial balance, such as $500.

2. During the year of conversion, do not establish Traditional pre-tax IRAs or perform rollovers.

3. Note that the “Backdoor Roth IRA” contributions are very similar to original Roth IRA contributions, however, in the event of an early non-qualified withdrawal, Roth IRA conversion contributions would be subject to penalties. Original Roth IRA contributions that are withdrawn are not subject to penalty.

Step by Step

Once it is established that you want the Backdoor Roth and you understand the tax implications:

- Make a non-deductible contribution to the appropriate tax year to a (new) Traditional IRA. If this is prior to April 15th of 2025, it might be possible to contribute $7,000 for the prior tax year and $7,000 for the current tax year (2024 & 2025). This is done at the investment company. Now in this case you should have $14,000 in a non-deductible Traditional IRA.

- Once you have the $14,000 in non-deductible Traditional IRA you may then initiate converting your $14,000 Traditional non-deductible IRA into a Roth IRA. You may use an existing Roth IRA.

Tax Forms and Taxes

- You will then receive a form 1099-R next year showing $14,000 of Traditional IRA to Roth IRA conversion.

- The preparer will then report this as a conversion on your tax return as tax free because there was never any tax deduction taken when you established the Traditional non-deductible IRA.

- Track / work with the preparer to track the total original Roth IRA contributions to date and the sum of all the conversions.

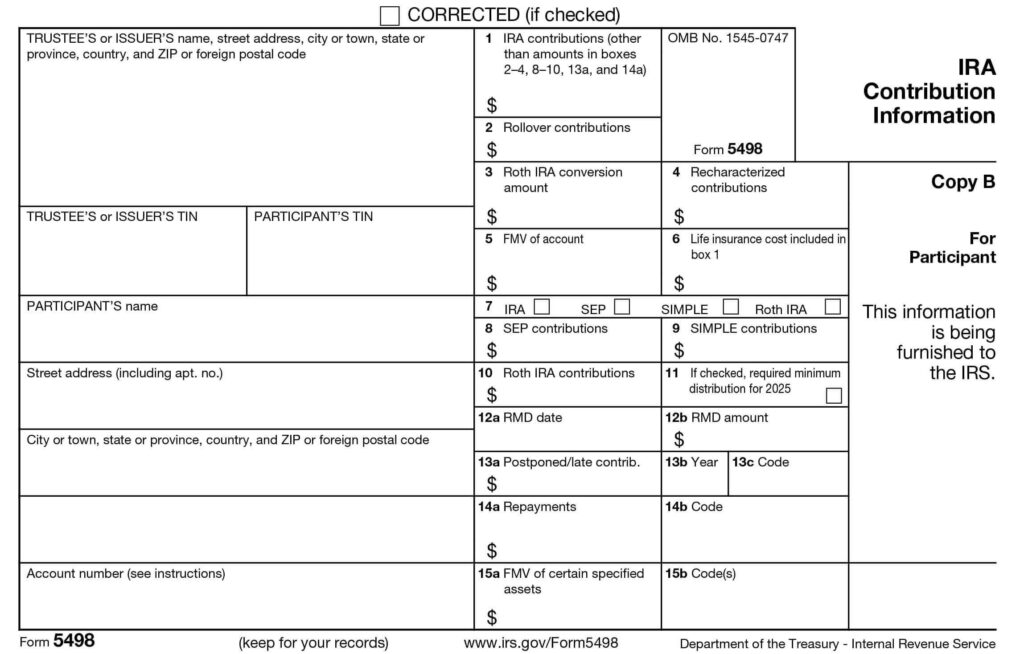

Here are some forms that are utilized: