How do you make the tax season less stressful?

All Videos

How do you make the tax season less stressful?

What are common mistakes individuals make when filing their taxes?

What are common mistakes small businesses make when filing their taxes?

Tricks and suggestions on trying to make the taxes successful is to start ahead. Why be a day behind when you could be half a year ahead and take advantage of things you can do during the year. The other part of this is organization, half of my job is getting staff members to help people organize your documents and intelligent efficient and easy way.

So ask your tax professional how they can help you organize and if you’re doing it yourself scan and documents along the way, start building up those charitable deductions and make sure before you even start the process that you’re adding things up and then checking back to the tax return, this is something you can do even before the tax software is out.

Now during the year to ensure no nasty surprises, well as planning opportunities, it’s great to project out, so you can use the prior year tax software or use a tool to project out, either professional tool with a professional or even hey, TurboTax Caster is not a bad tool, putting your income information, see where you are especially if you’re self-employed, If you’re looking to buy a house, what does it mean to sell stock, have a gain and then take those proceeds and put that to it down payment.

So, planning ahead being organized having those conversations early, and for a lot of people that they’re not accustomed to really high tax prep, fees, or places like Gillingham CPA, where we specialize in this stuff in the bills, tend to be over a thousand bucks a year, tell you prepared, I want your tax planning charge me for your time, charge me for your help and your expertise or else, they’re kind of work as fast as they can, to keep your fees down, and that gets the The job done, but if you really want to plan and plan for success, this is all year-round process.

Midyear check-ins, at least see what you can do during the year and then start early after the year. Don’t try and get stuff done when it’s super duper rushed and if you’re late, that’s fine, found extension, but before becomes April 15th get paid in as an individual. If you owe the tax, that will save you a lot whether you’re ahead of schedule or behind, don’t be rushing to get everything done in March, you can be ahead. It’s going to set you up for success, not only with the planning, the savings, but if you need loans down the way those lenders are probably going to want to see a tax return.

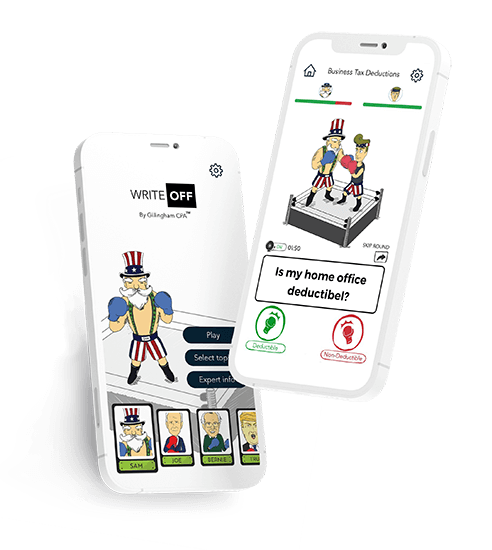

Write Off App

App for entrepreneurs to learn tax savings, structure correctly, & grow their business with an easy game.

A player chooses a character and plays each round against an opponent answering questions and learning on how to structure a business, pay less tax, and more along the way. It is a fun and interactive way to learn all you need fast!

About Us

Gillingham CPA is a San Francisco-based tax and accounting firm with a passion for helping clients grow their small businesses and navigating the tax waters. We specialize in consulting, boot-strapped startups, pre-series A ventures, and stock option -compensated employees. We take pride in providing services that go beyond just a tax return.

In addition to the general site, be sure to check out:

View All Videos