Taxes 101: Basic Tax Information

Taxes are compulsory payments to the government that fund public services. The main types are income taxes, based on earnings, and sales taxes, applied to goods and services at purchase. Deductions and credits can reduce tax liabilities. Staying informed about tax laws and seeking expert advice can optimize financial responsibilities and benefits for individuals and businesses. Understanding taxes empowers us to contribute to society through responsible taxation.

Tax Beginner Guide

What are common mistakes individuals make when filing their taxes?

What are common mistakes small businesses make when filing their taxes?

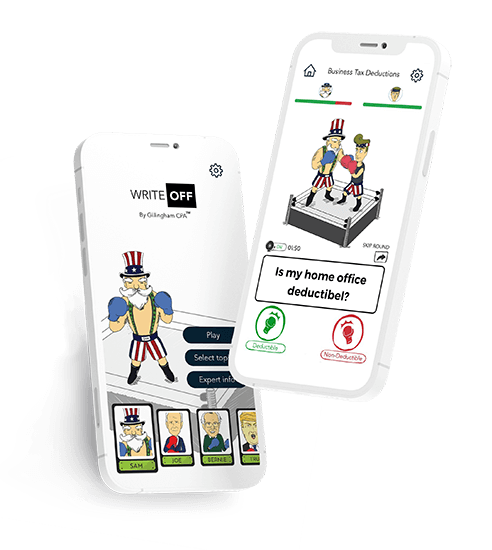

Write Off App

App for entrepreneurs to learn tax savings, structure correctly, & grow their business with an easy game.

A player chooses a character and plays each round against an opponent answering questions and learning on how to structure a business, pay less tax, and more along the way. It is a fun and interactive way to learn all you need fast!

About Us

Gillingham CPA is a San Francisco-based tax and accounting firm with a passion for helping clients grow their small businesses and navigating the tax waters. We specialize in consulting, boot-strapped startups, pre-series A ventures, and stock option -compensated employees. We take pride in providing services that go beyond just a tax return.

In addition to the general site, be sure to check out: